Asset Allocation & ROI Projection

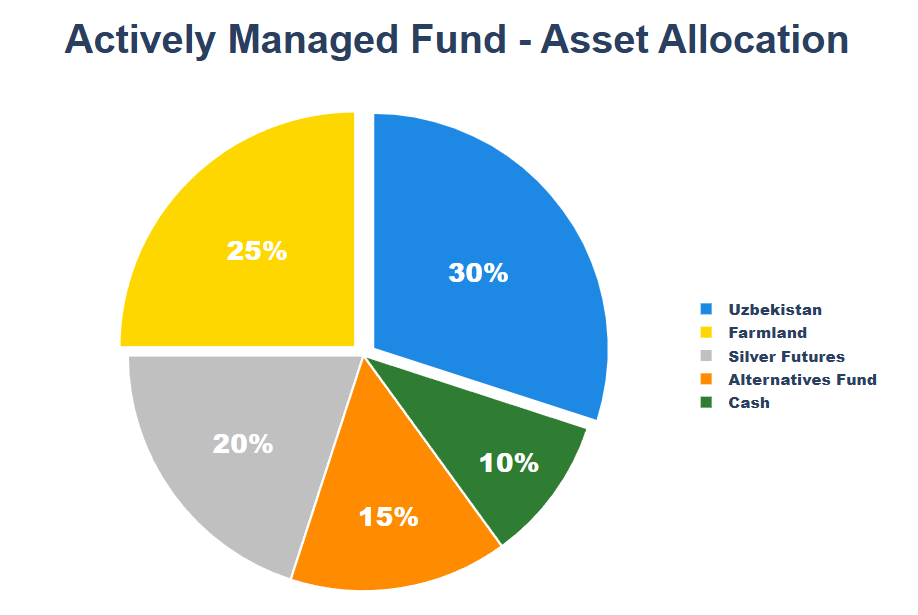

ag.online Fund I maintains strategic diversification across commodity-linked and real assets:

- Total AUM: $50 Million

- Projected Weighted 5-Year ROI: 49.1%

- Correlation to S&P 500: <0.3 (historical)

This allocation integrates stable yield vehicles (10% annual return floor via unique access to alternative investments) while capturing upside through direct farmland ownership, physical commodities, and frontier market exposure—providing risk-adjusted returns institutional clients require.

Strategy

Investment Approach:

We combine income-generating hard assets with growth-oriented commodity exposure, creating asymmetric upside with intrinsic collateral value.

Core Portfolio Construction:

- Uzbekistan (30%)– The AFC Uzbekistan Fund invests in public and private companies in Uzbekistan. With abundant natural resources, a young workforce, and pro-investment policies, the country is undervalued and positioned for substantial growth as a Central Asian commerce leader.

- Farmland (25%) – A large organic farm: long-term lease income and exceptional cash flow; water rights

- Silver Futures (20%) – For inflation hedge and industrial demand leverage

- Unique access to alternative investments (15%) – Alternative GP Stakes delivering consistent 10% annual income distributed monthly plus strong core NAV appreciation

- Cash (10%) – At-the-ready dry powder available for current asymmetric market opportunities

Operational Edge:

Direct sourcing eliminates intermediary layers common in fund-of-funds structures. All farmland and physical commodity holdings undergo proprietary due diligence and active management.

Fund Manager:

Dave Klivans

Co-Founder & Managing Partner

22 years executing real asset transactions across farmland, commodities, and alternative credit. Co-founded ag.online and Bella Groves with demonstrated track record in direct agricultural investments.

Dave has structured 100+ transactions spanning single-family, multifamily, land, and senior housing before concentrating exclusively on commodities and agriculture. His operational background provides sourcing advantages in fragmented farmland and physical commodity markets.

Advisory & Operational Partners:

- An Alternatives Fund Partner (yield vehicle management)

- AFC Uzbekistan Fund (frontier market broad exposure to growth)

- Specialized agricultural analysts and commodity strategists

- Tax/legal/audit

Contact

ag.online Fund I

6500 River Place Blvd, Suite 250, Building 7

Austin, TX 78730

dk******@**.online | 512-789-1905

Past performance does not guarantee future results.